Betting Apps Without Verification

It is no longer possible to create a new Gmail account without verifying a mobile phone number.If you don't have access to a phone number that can receive either text messages or phone calls, you can either gain access to a temporary phone number, or use a friend or family member's phone for the verification process. Sports Betting Apps vs. Online Betting Sites. Using only the best sports betting apps to house your real money action offers a lot of added benefits. While online betting sites provide some of the same perks, they can’t match everything mobile betting apps bring to the table. Here are just a few of the most important advantages of choosing to. Click on the Verify button below to complete human verification and get your money. Verify Note: Once you've passed the human verification, $100 Cash App Money will be sent to. Michigan online sports betting apps launched on Janaury 22, 2021. Michigan’s Lawful Sports Betting Act legalized both live and online sports betting in the state. In a situation unique to the legal US sports betting industry, Michigan’s tribal casinos, as well as commercial casinos, own and operate mobile sports betting platforms in the state. Enjoy the best online betting experience at Virgin Bet. Browse all the latest odds across our huge selection of sports betting markets (T&Cs Apply).

GeoComply is a global leader in geolocation compliance technology. Since launching in 2011, GeoComply has quickly become the iGaming industry’s trusted solution for reliable, accurate and precise geolocation services.

GeoComply’s patented and proprietary geolocation compliance solution is unparalleled in its level of accuracy and integrity, as well as in its depth of security and ease of implementation.

GeoComply location services to protect your business

Combining the power of iBeacons with GeoComply’s robust geolocation compliance solutions, our indoor solution, PinPoint, allows for gaming to be restricted within specific zones of a gaming property to within a few meters of accuracy. PinPoint was designed specifically for the gaming industry’s unique requirements and offers the same real-time anti-spoofing and fraud benefits as the mobile and desktop solutions. PinPoint’s advanced detection and monitoring system can even anticipate movements to alert players before leaving permitted areas, making for a seamless and uninterrupted play experience.

GeoComply’s Solus solution offers a no-download compliance option that works directly within the operator’s website. For spoof-proof geolocation within the browser, the customer is prompted to allow their location to be shared in order to allow for secure collection of location data. The browser geolocation experience can be customized according to security and compliance needs of the operator, for both desktop and mobile web user experiences.

GeoComply’s solution is able to both profile and detect high-risk behaviors and/or devices, using a comprehensive set of data that can pinpoint such activity in real time – whether the player is using a browser-based, mobile or desktop application. GeoComply’s anti-fraud and chargeback reporting offer an invaluable way for operators to stop collusion, as well as for payment gateways and merchants to prevent fraud and improve chargeback rates. Working closely with the payment providers, GeoComply has been able to reduce the cost of chargebacks to their merchants by at least 85%.

For downloadable client applications designed for the desktop and mobile, GeoComply’s software is designed for bundling within such an application. The location verification will thus occur seamlessly in the background during the customer’s session, without any intrusion to legitimate customers’ user flow/experience.

GeoComply’s system provides access to detailed logs and analysis of all transactions from a single Back Office portal. Custom reporting allows for detailed analysis of potentially fraudulent transactions in addition to the real-time data provided via industry-standard RESTful APIs. Traffic filtering and rules parameters can be independently configured and deployed to multiple products, device types, jurisdictions and/or URLs simultaneously, all from one central system.

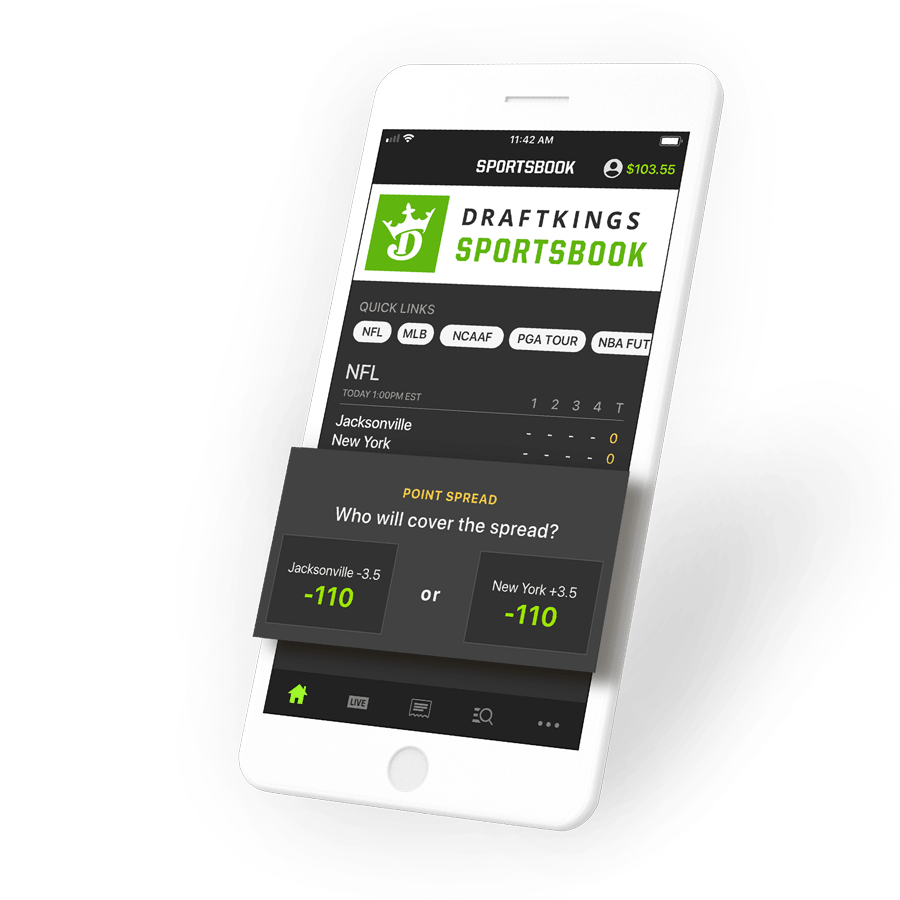

The ever-changing daily fantasy regulatory environment requires a geolocation solution that can keep up. GeoComply’s flexible exclusion tool allows changes to approved jurisdictions with the flip of a switch. Proprietary map boundaries are updated on a weekly basis to ensure pinpoint accuracy along borders. GeoComply provides location services to several leading DFS providers, such as Draft Kings. “We are committed to the integrity of our product, which is why we are partnering with GeoComply to leverage their industry-leading geolocation compliance solution,” said DraftKings COO Paul Liberman. “The introduction of this new service is part of our ongoing efforts to ensure that we continue to meet and exceed the increasing demands within the DFS industry, while also continuing to innovate.”

GeoComply works with industry leaders, including PokerStars, World Series of Poker, Party Poker, among others. For seamless integration that meets the needs of savvy poker players, GeoComply’s software is designed for bundling within desktop and mobile apps. The location verification occurs seamlessly in the background during the customer’s session, without any intrusion to legitimate customers’ user flow/experience. GeoComply’s robust back office system also identifies potential collusion and actively fights poker-specific fraud methods which may be used by malicious users to circumvent system checks.

For instant play games, GeoComply’s software is embedded within the operator’s website and mobile apps. This easy integration allows for a single download for the social and regular players alike. GeoComply offers two browser solutions to allow for flexibility depending on regulatory requirements in each jurisdiction. GeoComply provides unrivalled geolocation services for regulatory compliance against the world’s most stringent iGaming regulations in the US and abroad, and serve 100% of the iGaming market in New Jersey, Nevada and Delaware.

GeoComply provides geolocation compliance services to approved sports betting markets to ensure operators remain compliant to PASPA and state regulations by ensuring users remain within the borders. Our technology can be adapted for both mobile and desktop betting interfaces, in order to support browser and app-based wagering. These solutions can be easily adapted to work within the confines of regulatory frameworks specific to mobile-based wagering networks or other unique compliance requirements. Our most recent collaboration with MGM in Nevada showcases our seamless mobile app integration for sports betting within the state of Nevada.

When the Georgia Lottery elected to go above and beyond regulator requirements to implement the same stringent standards as the New Jersey iGaming market, there was only one geolocation provider who could provide that level of service; GeoComply. While GeoComply’s solutions are scalable to allow for a wide variety of requirements, additional value comes from the robust reporting tools that provide customer service agents specific feedback in order to troubleshoot effectively with the iLottery industry’s player demographics.

NEWSALL NEWS

GeoComply Makes $200,000 Donation to Conscious Gaming to Fund Operations as Momentum Continues for PlayPause January 14, 2020

David Briggs, GeoComply’s CEO, will be participating in a “fireside chat” at the Jefferies Virtual Sports Betting &

A to Z of Personal Licensing for Emerging US Sports Betting & iGaming Sectors Webinar November 19th 11am-12pm

999 West Hastings Street.

Vancouver BC V6C 2W2

Canada

+1 604 336 0877

8329 West Sunset Road.

Las Vegas NV 89113

United States

+1 725 735-4926

GET IN TOUCH WITH US

Inability to receive OTP is a Problem encounter during some online and E-payment. In this article, you’ll learn how to solve OTP problem. So, if you not receiving OTP on your phone; keep reading…

What is OTP?

OTP stands for One-Time Password. It is generated by the Safetoken Service. OTP is also referred to as safetoken. Safetoken/OTP and transaction limits are being put in place for your protection as part of the mandatory regulatory compliance by the CBN.

To make online shopping even more secure, online payment processors generate this second level security for your safety. This second level security is a 6-8 digit One Time Password (secure OTP). This help to protect your credit card and payment on the internet.

Online payment gateway without OTP

There is No secured online payment gateway that does not ask for one time password (OTP). If you’re using Mobile App to make payment, a token may be required. Any online payment without secure OTP or token is NOT fully secured. It is not advisable to shop or make payment via such online payment platform. So, do not try bypass OTP when making online payment.

Importance of OTP in Online Payment/transactions

Betting Apps Without Verification Registration

- OTP help you carry out online transactions above the default limits set by your bank.

- OTP will always help you enjoy the remember card feature for Verve Cards which requires only your CVV2 and PIN to complete transactions.

You will receive an OTP on your registered mobile phone number automatically, when you use your card for making online payment at websites that support verified VISA or MasterCard® SecureCode™ authentication.

To avoid running into the problem of not getting your OTP verification code SMS text message quick when you initiate online payment, ensure that you use your primary mobile phone number ( that is the mobile number registered with your bank account and link to Verve card, Mastercard or VISA Card). This helps to avail fast authentication.

There are over twenty web payment platforms in Nigeria, if you try using your verve card, mastercard, visa, or other bank credit card to make payment on any of these webpay enabled platforms and it didn’t work; it means you have to register for secure OTP.

Solving OTP problem and Receiving OTP on your phone; to solve OTP problem, register and link your mobile number to your account.

How can you register for secure OTP in Nigeria

There are 3 ways to register for Safetoken/OTP service namely;

- Activation by your Bank.

- Activate on the Quickteller App.

- Self-Activation at the ATM.

How to self-activate Interswitch Safetoken/OTP on ATM for online payment

The Interswitch Safetoken Service system generates a 6-8 digit One-Time-Password (OTP) whenever a transaction is initiated via the Interswitch Web Payment Platform.

PLEASE NOTE THIS: The customer’s card would have been previously linked to his phone number for him/her to utilize this service. At the point of initiating a transaction, the customer may receive an OTP via hardware/software devices, grid cards or SMS and then he is required to input this OTP on the web payment platform in order to complete the payment.

The OTP is authorized by the Strong Authentication Server residing either at the switch or at the issuing bank and the transaction is completed.

To register for OTP SMS verification code, follow the prompt;

- Go to the nearest ATM, and insert your ATM card

- Input your 4-digit PIN and press Enter

- Select your bank account type example Savings or Current

- Select the ‘Quickteller’ option from the ATM menu screen

- Select ‘Pay Bills’ from the Quickteller menu list on the ATM screen

- Select ‘Others’ for the bill payment menu option list

- Enter ‘322222”as the Biller Code

- Enter your mobile Phone Number as the Customer Reference Number and select ‘Proceed’

You will get a display “Do you want to make this payment?” Amount Due: N1. DO NOT edit the amount to be paid

9. Click on “Pay amount due”. You will then receive an SMS confirmation page indicating the registration was successful.

What you can do when you do not receive an SMS with a secure OTP after requesting for one?

Make sure you’ve been receiving banking messages on your phone before otherwise visit your bank. Send a mail to [email protected] for assistance in making sure you get your OTP or dial a short code *322*0# to proceed to receive an secure OTP.

If you get error when you try to activating your card for Interswitch OTP service, send an email to [email protected] For more information, visit the interswitch Safetoken faq at: https://connect.interswitchng.com/faqs/safetoken-faq/.

Betting Apps Without Verification Online

OTP is needed for secured online shopping and any online payment platform without OTP is not fully secured. If you follow the instructions above, you will never have problem with your OTP verification code.

Generating OTP and activating new union bank UnionMobile App

If you’re a new union bank UnionMobile App User;

- Download the new UnionMobile App on your android phone from Google play and accept the Terms and Conditions

- Enter your account number (OTP will be sent to the mobile phone number registered with the bank)

- Enter the OTP you received on your registered mobile number

- Choose username and password

- Choose a new password and transaction PIN then submit

- Return to home page and Log in

If your Existing Users

- Download the new UnionMobile App on your android phone from Google play

- Sign in with your UnionOnline username and password

- Enter your account number and submit (you’ll receive an SMS containing OTP on your registered phone number)

- Enter the OTP

- Create Transaction Pin

- You are successfully registered, go to home page and login

Finally, to receive OTP on mobile from any bank for any purpose, the mobile number must be registered with your banking account. In your case it seems mobile number is not registered with your banking account and hence you are not receiving OTP from your Union Bank for mobile banking.

Visit your bank and get your mobile number registered to account and starting receiving OTP on your registered mobile number. Please down load the new union bank mobile app from your registered mobile number with the bank. Where you can get the OTP. Please do not disclose any of your credentials to anyone. In case of difficulties please visit any of union bank branch.

If you enjoyed this article, show some love…don’t just read, asks your questions, share and drop some comments.